Mr. Reset

Mr. Reset here. I’ve looked at your credit report and have some recommendations for you.

- Objective advice

- Expert insight

- No phone call required

Less debt, less doubt. No calls required.

See what’s possible

Debt’s a powerful tool–but it’s not good when it gets out of control. That’s ok, because you have options.

What is debt relief?

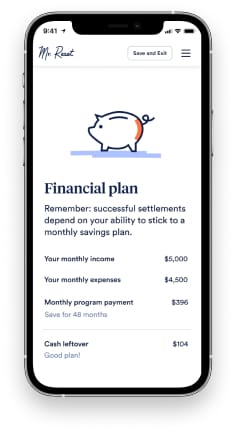

Debt relief programs change the terms of your debt to make repayment more manageable.

Apply with confidence

Find the strategy that works best for you: monthly payments you can afford and the amount of relief you need. No surprises.

The right kind of relief

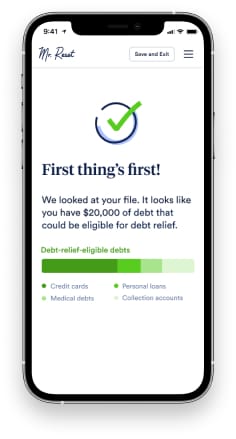

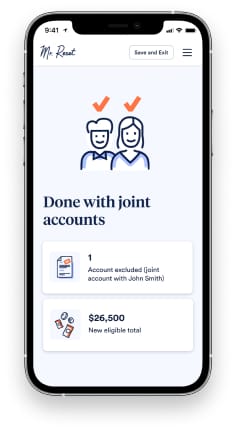

Not all debts are a fit for debt relief. We’ll help you understand when that’s true and why.

Say goodbye to debt stress

Stop wondering, “what if?” Implement a plan for tackling your debt today.

Something to celebrate

Take pride in knowing that you’ve done something great for you and your family.

Our commitment to you

Expert analysis

We’ve helped thousands of people understand how much they could save and which of their debts qualify.

A plan you can understand

When you’re done, you’ll understand which of your debts are a good fit for debt relief, and why.

Fast, private, free

Our service is totally free and private, and doesn’t require a phone call.

Who is Mr. Reset?

Hi, I’m Mr. Reset. If you’re here, you probably have some debt, and that’s ok. Most Americans do!

The good news is that there are all kinds of things people can do with their debt, like getting a better loan, negotiating settlements, reorganizing your payments, and more. I’ll help you find the right one for you.

Frequently asked questions

Who is Mr. Reset?

Mr. Reset is a service created by people who believe that tackling your debt shouldn’t begin with speaking to a stranger in a far-flung call center.

These are my finances we’re talking about. Is this service secure?

Mr. Reset doesn’t sell your data, which is protected by state-of-the-art security protocols and encryption. With your consent, Mr. Reset introduces you to a trusted partner to help you with your debt.

I’m busy and stressed. How long does this whole process take?

It depends on your situation, but the assessment questionnaire is quick and easy to follow.

Will Mr. Reset clear up all my debts for good?

Some options focus on unsecured debts. Bankruptcy, however, helps you resolve both secured and unsecured debts.

I can’t afford another bill! How much will all this cost?

Mr. Reset is free to use. But if you go ahead with a debt resolution strategy, you’ll pay the partner a fee. These fees vary, and some of them are contingent on performance.

If I decide to move ahead with a debt resolution program, is it risky?

You can pick a strategy, start pursuing it and stop before the program is complete. If you do this because you realize you need more aggressive assistance that may be ok. But if you just quit you could find yourself in a significantly worse financial position than before.

Will this process repair my bad credit?

No. But it can help you get your finances in order and access credit responsibly. That’s the best way to improve your credit rating in the long run.

Can I ever borrow again?

None of the debt resolution options offered prevent you from borrowing in the future.